The Ideal Salesperson

The Ideal Salesperson in the Age of Digital Platforms: Consultant, or Facilitator?

TL;DR: The rise of digital platforms that provide product comparisons and qualified information has shifted power to customers, diminishing the traditional role of the salesperson. This article examines how companies should respond, proposing a segmentation matrix based on consumer knowledge and product complexity. Four sales approaches emerge: consultative selling for less‑informed customers with complex solutions; efficient facilitation for informed customers confronting complex offerings; educational support for less‑informed customers buying simple products; and simplified processes for well‑informed customers purchasing low‑complexity items. Managers are advised to adapt training, metrics and compensation to these segments to keep sales teams relevant in the digital age.

This article is co-authored with Leandro A. Guissoni and Lucas S. Prado and was originally published in Portuguese at GVexecutivo. The published version included several edits and simplifications. What follows is the full, unedited version, with additional examples and explanations.

Until the beginning of the 21st century, the salesperson occupied a central and almost uncontested role in the purchasing process. Without easy access to information, consumers depended exclusively on these professionals knowledge to understand characteristics, prices and conditions of products or services1. One example was the insurance market: to compare policies, the client had to consult several brokers, since information about plan options offered by insurers was inaccessible outside this intermediary. This scenario was repeated in sectors such as real estate, automobiles, retail of electronic products, financial services and even segments of health. In this phase, the sales agent not only held control of the information but also had broad influence on the customers decision, often motivated by commissions or partnerships with specific suppliers.

The consumer had to dedicate time to in -person visits and ran the risk of receiving biased guidance, without convenient means to validate the information independently. To try to reduce the risk of bias from sellers, consumers had to consult multiple providers of products and services to compare options and make a decision. This was the reality, for example, in the automotive sector. In 2007 the consumer made, on average, five visits to dealerships to close the purchase of a car. In 2023 this average was only two2. Research institute analyses in the sector indicate that car buyers visit fewer dealerships, reducing the influence of sellers in the face of increased online engagement in the search for information until choosing the car3.

Thus, with the popularisation of the internet from the 2000s onwards, the balance of power began to change4. Social networks, communities and discussion forums democratised access to information5. A customer who wished to take out car insurance, for example, began to be able to research coverages online and read reviews from clients even before talking to a broker. This empowerment of the consumer and the decline in many clients interest in relating with sellers forced companies to rethink the role of the seller6. In a first moment of digital inclusion, consultative selling assumed an important role7, where the professional ceases to be a repositor of information and becomes a solver of problems, complementing the information available online8. Their function became to identify non-obvious needs and personalise solutions, adding value beyond what the client already knew. During this period, the seller remained relevant, but their authority diminished: the client arrives at the negotiation already informed and demanding differentiated proposals9.

However, this consumer empowerment would reach a new dimension throughout the 21st century, with the emergence of digital business models and greater digital inclusion of the population10. Today not only is information widely available, but platforms and new companies emerge to facilitate consumer decision-making and even eliminate intermediaries in the purchase process11. Solutions such as Minuto Seguros operate as autonomous platforms: algorithms cross data on preferences, prices and user evaluations, allowing the consumer not only to have more information but also to complete complex transactions without interacting with traditional sellers. A recent study shows that 68% of B2B buyers prefer online interactions over dealing with a seller due to convenience, price transparency and access to evaluations from other clients12.

These transformations raise a critical question: how can sellers maintain their relevance and assist the client in concluding their decision-making journey without generating friction? Is there still space for the consultative seller? To answer these questions we adopted a multifaceted discussion that included cases of companies that eliminated intermediaries with digital platforms and a review of recent literature on how digitalisation impacts consumer behaviour and sales strategies. From the discussion of the practical implications of this new reality, we point out challenges and opportunities for sales managers in a scenario of growing customer autonomy.

The Change in the Customer Value Chain

Recent literature on sales has explored how digitalisation is transforming the practice of selling due to changes in the customer journey13. It argues that customers have gained power due to greater access to information, requiring sales teams to set aside approaches focused only on transactions and adopt new strategies14. Consequently, previous studies recommend that sellers should assume the role of value facilitators and relationship creators15. In addition, the literature highlights that technology is not totally replacing sellers but rather transforming their functions, making digital skills16, data-based decision-making and customer-engagement abilities17 essential.

However, in line with other studies18, we argue that this discussion goes beyond a more or less consultative seller. Changes in consumer behaviour, increasingly digital, not only involve greater access to information but are enabled by the emergence of new business models that coexist and sometimes compete with the traditional activity of sales teams19. In this scenario, it is important to understand at which moments of the journey the consumer really needs the guidance of sellers and in which they prefer to decide autonomously.

To understand the changes in consumer behaviour, it is essential to observe the disruptions caused by the phenomenon of decoupling in different industries. This concept, developed at Harvard Business School, is described in the work Unlocking the Customer Value Chain20 and in various articles in Harvard Business Review21, The Economist22 and other journals23. It describes how consumers have begun to separate stages of the purchasing process that were previously performed together. With the advancement of digital solutions, customers can, for example, search for information or compare products without depending on traditional companies. Examples include platforms such as Bestreviews.com, Wirecutter or Escolhasegura.com.br, which allow the consumer to decide which product to buy without needing guidance from sellers leaving the store with only the role of finalising the transaction. This format presents itself as a more autonomous24, convenient and trustworthy25 alternative for consumers to acquire products and services.

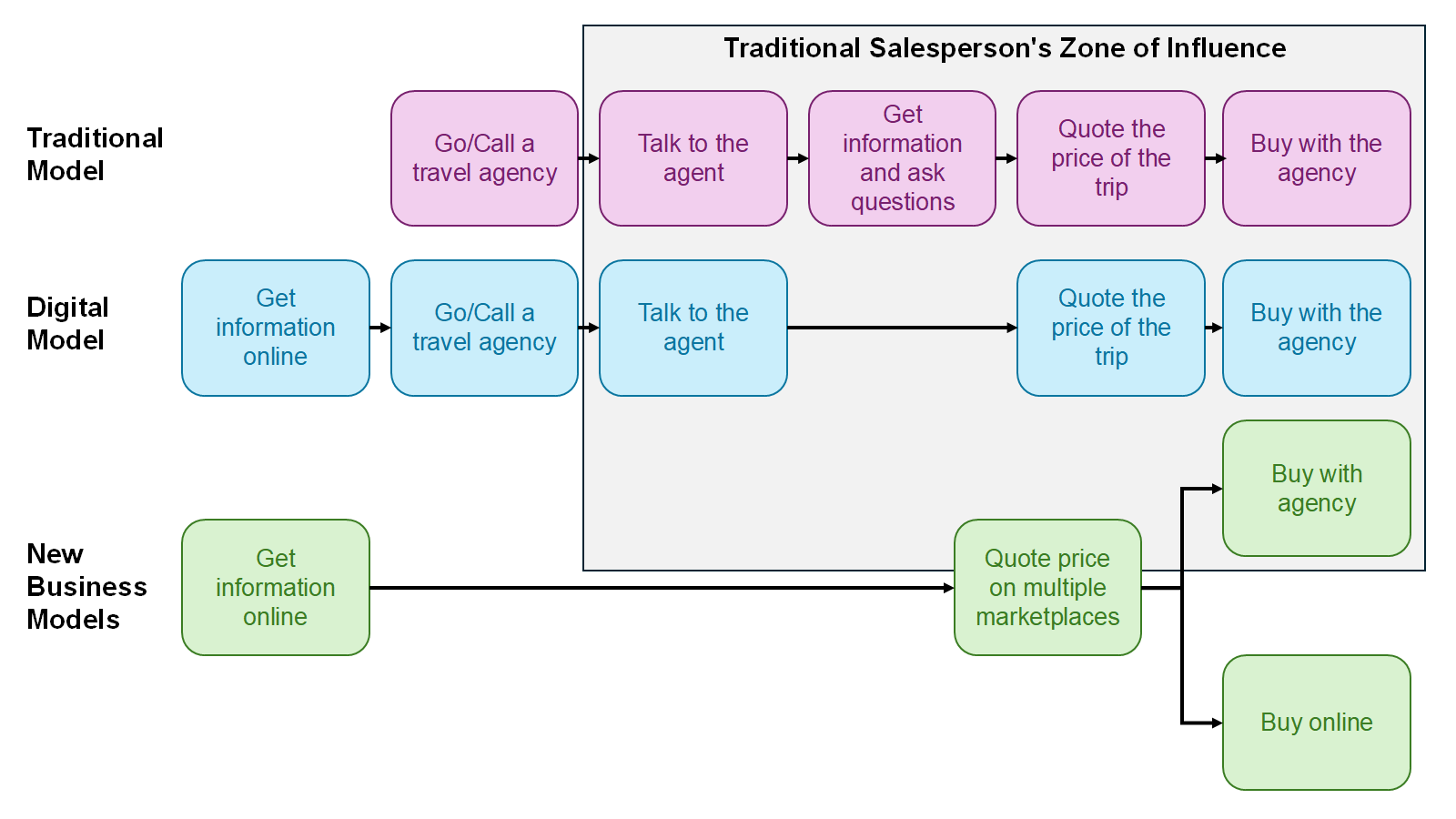

** 1.*\ *The Transformation of the Consumer Value Chain in the Tourism Sector

The reduction of the traditional influence of the seller is not restricted to a single sector. Multiple markets, from traditional consumer goods to B2B26, experience structural changes in the relationship between customer and supplier. In the real estate market, for example, platforms like Zillow have begun to replace stages that previously depended heavily on real estate agents: consumers now research properties, evaluate prices through algorithms (such as Zestimate) and even close deals more transparently and autonomously. In the automotive sector, sites such as CarGurus and WebMotors allow comparisons of vehicle models, financing rates (as on Comparabem.com.br) and insurance (as on Minuto Seguros), reducing visits to dealerships and decreasing the need for interaction with sellers to understand basic attributes. In agribusiness, networks such as Farmer Business Network decouple the purchase of inputs from direct contact with distributors by offering price comparisons, technical recommendations and agricultural practices through digital platforms.

These examples reveal an emerging pattern, as shown in Figure1: activities that traditionally required the sellers involvement such as research, comparison and evaluation of options are being decoupled. As a result, the relationship between customer and seller becomes more punctual and transactional. In many cases, the consumer only contacts the seller at the final moment of purchase, already with the decision made and information in hand.

The Role of the Seller in This New Context

However, a question arises: if the customer is increasingly informed and decided, do they really need a consultative seller? Or just a seller to take the order and reduce bureaucracy in the purchasing process? Or else: for which customer profile is the consultative approach most relevant? The challenge for companies is to identify when and how to adjust their sales teams to this new reality27, in which transparency and trust are fundamental.

Academic studies have observed that the consultative seller must adopt distinct approaches depending on the context. For example, in complex scenarios with greater demand for technical knowledge, reducing uncertainties and offering integrated solutions can make the difference for the customer28. When the client arrives equipped with information about products or services, they expect transparency, speed and quality in the interaction29. Thus, the answer lies in the notion of customer segmentation identifying in which scenarios the seller will assume a strongly consultative posture and in which they should act primarily as a facilitator, minimising bureaucracy and qualifying the decision-making process.

Our analysis suggests that in certain scenarios the seller can and should maintain a consultative role, especially with complex products such as irrigation systems for agribusiness, where technical knowledge is essential and the customer has difficulty obtaining information on their own. In other cases, where there is a wide availability of digital information, the seller should concentrate on reducing bureaucracy and speeding up the sales process, acting more as a facilitator than as a consultant that is, focusing on facilitating the decision efficiently.

To help managers evaluate the stage their sector is in and how the seller should act, we propose below a checklist with key questions. These questions serve as a starting point to reflect on the degree of customer autonomy, the reliability of the available information and the profile of buyers that the company serves.

Checklist of key questions:

- In your industry, are there startups or digital business models focused on comparing products and educating the customer?Many industries are being transformed by startups that offer comparisons of products, services, attributes, prices and functionalities. These business models can also educate the customer by providing digital content, tutorials or detailed reviews that facilitate choice. These platforms help the customer to become more informed and less dependent on sellers for basic information.

- What is the level of trust in the available information?Despite the large amount of information available to assist consumers in searching and evaluating alternatives, it is not always reliable. Thus, in markets where there is little reliable information, consumers may arrive with many doubts about what is actually best to solve their pains and needs.

- What customer profile is most likely to adopt these digital models?The customer most likely to adopt these digital models is generally younger, more familiar with technology and seeks to optimise time and effort30. They value independence and self-learning, being more rational in their decisions. This profile includes those who prefer to perform comparisons and make decisions based on objective data such as prices and functionalities instead of relying on interaction with sellers.

- How to segment the customer according to their level of decision?Customer segmentation can be done based on the level of knowledge they have when entering the sales process. It is possible to use lead scoring tools or ask exploratory questions at the beginning of the interaction whether face-to-face or digital to assess how much the customer already knows about the product or service. Questions such as How much have you researched about this product? or What comparisons have you already made? can help determine whether the customer needs a more consultative seller or a seller focused on facilitating and speeding up the purchase process.

How to Segment Customers and Adapt the Role of the Seller

This approach will allow companies to direct their customers to the type of seller that best suits each situation31: a consultant for customers who need detailed guidance on complex products, or a more transactional seller for those who already have enough information and seek to optimise the time of purchase.

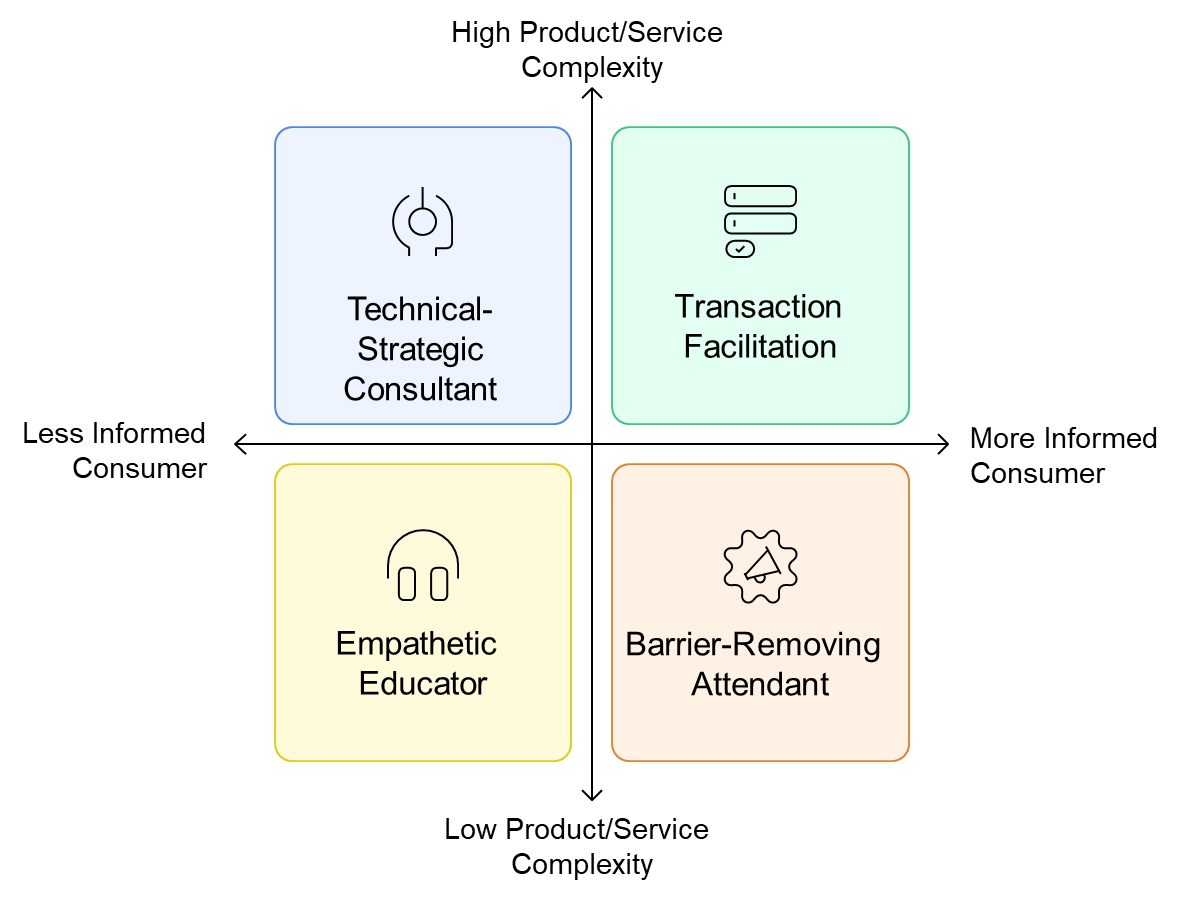

Based on the discussions presented in this article, we propose a matrix (Figure 2) that guides the definition of the most appropriate sales approach, considering two main factors: (1) the degree of consumer information and (2) the complexity of the product or service. The intersection of these two axes gives rise to four quadrants, each with distinct implications for the performance of sellers, the design of commercial teams and the use of digital tools. We summarise the main aspects and characteristics of each sales approach in Table 1, along with examples.

Figure 2. Segmentation Matrix for Sales Approach

Technical-Strategic Consultant (Less Informed Consumer & High Complexity Product or Service)

In this quadrant the seller acts as a consultant, taking a central role in the decision-making process. When the customer has little knowledge and the solution is complex, the sales force must go beyond presenting features, translating technical information into accessible language and guiding each stage of the purchase.

Common examples include sectors such as agribusiness (where adopting a new fertiliser or crop protection requires not only technical mastery but also the ability to contextualise the product to the specific needs of each farm) and the B2B market for corporate software, automation systems or corporate health plans complex solutions with multiple decision-makers and high added value, which require a seller capable of clarifying doubts and demonstrating strategic impacts.

From a managerial perspective this quadrant demands experienced professionals with strong technical repertoire and active listening skills. Companies should invest in training not only about products but also about the sector and the customers challenges. Performance indicators must go beyond volume goals, considering satisfaction, depth of the relationship and success of implementation. In many cases, consultative selling marks the beginning of a long-term relationship based on trust and continuous value creation.

Transaction Facilitation (More Informed Consumer & High Complexity Product or Service)

In this quadrant the consumer has already completed a large part of the buying journey on their own. They have studied the product, compared options and arrive at the company with a high level of knowledge, often already decided. However, due to the complexity of the solution they still face operational, technical or bureaucratic barriers. The role of the seller, therefore, is to facilitate the process, removing obstacles and ensuring a smooth experience.

This is the case, for example, when buying a car. The customer arrives at the dealership informed about the model, version, price and financing conditions. It is up to the seller to recognise this preparation and focus on simplifying stages such as test drive, negotiation, documentation and delivery. The same applies to sales of high-value personal technology, technical corporate services or industrial solutions for experienced buyers.

In this context the challenge is not to inform or convince, but to avoid friction and provide efficient support to the customer. From a management point of view this requires agile teams, with mastery of internal processes and a focus on solving problems quickly. Training should prioritise objective negotiation skills, clarity in communication and the use of digital tools32 that streamline the flow, such as integrated CRMs or electronic signatures. Key indicators include average closing time, conversion rate in the final stages and satisfaction with the process.

Empathetic Educator (Less Informed Consumer & Low Complexity Product or Service)

In this quadrant the consumer knows little about the offer, although the product or service is of low complexity. The role of the seller is educational: to clarify basic doubts, reduce insecurities and provide the essential information so that the customer decides with confidence, without excess technical detail.

Common examples include contracting basic life insurance, popular dental plans or simplified financial services. In these cases the customer needs clear explanations, empathy and patience not in-depth technical analysis. The same occurs in face-to-face sales of digital services or mobility solutions for audiences with little technological familiarity. In practice this requires didactic sellers who adapt their communication to the customer profile and use simple examples and visual resources to facilitate understanding. The focus is less on persuasion and more on clarification, helping the consumer to overcome the barrier of the unknown.

From a managerial point of view it is important to select welcoming professionals, train them in clear communication and provide standardised support materials. Relevant indicators include the customers level of understanding, service time, conversion rate and frequency of recurring doubts. When well executed this approach not only facilitates the sale but strengthens the relationship with the customer, who feels valued.

Barrier-Removing Attendant (More Informed Consumer & Low Complexity Product or Service)

In this quadrant both the consumer and the offer present low complexity. The customer already knows what they want, has the necessary information and seeks a quick, direct and obstacle-free purchase. Here the role of the seller is minimal, often replaced by self-service channels and efficient digital platforms.

The priority is to eliminate friction. The consumer wants to complete the purchase with minimal interaction and without unnecessary steps. Examples include repeat purchases of simple electronics, recurring consumption items or accessories, where any bureaucracy can generate dissatisfaction. In practice companies should invest in agile journeys with simplified checkout, quick payment and integration with loyalty programs. When there is human interaction it should be punctual and problem-solving, such as a chat agent who quickly clarifies a doubt.

From a management perspective the focus should be on operational efficiency, system usability and channel integration. Training of teams should prioritise agility and objectivity, avoiding consultative efforts that do not add value. Technology is the main ally in this model. Performance metrics should also reflect this logic: average transaction time, cart abandonment rate, repurchase percentage and Net Promoter Score (NPS) of the process are more relevant than traditional sales indicators.

Table 1. Summary of Sales Approaches by Quadrant

| Profile | Technical-Strategic Consultant | Barrier-Removing Attendant | Empathetic Educator | Transaction Facilitator |

|---|---|---|---|---|

| Competencies | Active listening, translating complex information into accessible language, negotiation skills. | Mastery of internal processes, objectivity, speed in negotiation, and focused communication. | Didactics, patience, clear communication, listening skills, and use of simple examples to explain the product/service. | Focus on operational efficiency, organization, speed, and simplicity; basic product knowledge. |

| Support Tools / Technologies | Advanced CRM, technical simulation platforms, detailed presentation materials. | Integrated CRM, chatbots or virtual assistants for specific questions. | Simple visual support materials, standardized explanation scripts, platforms for basic seller training. | Optimized e-commerce platforms, simplified checkout, integration with payment methods and loyalty programs. |

| Compensation Model | Commissions linked to higher-value sales and long-term relationships, possibly including bonuses for customer satisfaction. | Variable compensation focused on conversion rate and speed of closing, with possible incentives for satisfaction. | Possible combination of fixed salary + variable pay based on conversion and customer satisfaction goals. | Simple structure with volume or transaction goals; in some cases, fixed pay if the process is mostly digital. |

| Metrics | Customer satisfaction, depth of relationship, success of implementation, and sales recurrence. | Average closing time, conversion rate in the final funnel stages, and satisfaction with the process. | Perceived level of understanding, conversion rate of new customers, recurrence of questions, and long-term loyalty. | Average transaction time, cart abandonment rate, repurchase percentage, and process NPS. |

| Examples of Products / Sectors | - Agribusiness (fertilizers, high-tech crop protection) - Enterprise software - Industrial automation systems - Corporate health plans |

- Vehicles (cars, motorcycles) - High-value tech devices (e.g., advanced computers) - Specialized consulting - Corporate security systems |

- Basic life insurance - Dental plans - Simple financial services - Prepaid internet plans |

- Repurchase of simple electronics (chargers, headphones) - Recurring consumer goods (supplements, personal hygiene) - Printer cartridges and refills - Direct e-commerce without human interaction |

Conclusion

Digitalisation and the growth of independent product comparison platforms have contributed to a phenomenon increasingly present in purchase journeys: decoupling. When consumers are able to autonomously perform stages that previously depended directly on interaction with a seller such as searching for information, comparing options and even simulating prices a separation occurs between moments of the journey that were previously interconnected. This movement has reduced information asymmetry and forced companies to rethink how, when and for whom the seller still generates value.

In this context, it is not that the role of sales has lost relevance but that it is no longer necessary in all cases. The seller remains fundamental in moments when the customer is poorly informed or when the product requires specialised guidance but their presence may be redundant when the customer already masters the process and seeks only agility.

To support companies in this new scenario, this article proposed a checklist for managers and a segmentation matrix based on two axes the degree of consumer information and the complexity of the solution resulting in four distinct commercial approaches. The matrix translates, in a practical way, the impacts of decoupling and guides how to reposition the sellers role at different points in the customers journey.

This structure offers direct implications for commercial management:

- Training of teams should be adapted to the interaction profile of each quadrant, prioritising technical, didactic or operational skills according to demand.

- Performance indicators need to go beyond volume goals, incorporating metrics of efficiency, quality of experience and post-sale success.

- Compensation models should reflect the type of delivery expected, avoiding rewarding only volume in contexts that require relationship building or technical support.

- Retention and loyalty strategies should be segmented, considering clients who value consultative support, autonomy or simplicity in the process.

- Integration with marketing is essential to identify, already in lead generation, the customers level of information and the degree of consultative support required.

- Finally, it is up to the seller, through exploratory questions, to identify the clients informational profile, allowing managers to define adequate processes for each type of journey.

In summary, the seller remains relevant but not for all customers in the same way. As information asymmetry decreases, the responsibility of companies increases to create smarter, personalised and integrated sales strategies aligned with the consumers journey. With the application of the presented matrix, managers can evolve their sales force, transforming it from a single, standardised model into a more agile, contextual structure centred on the real value that the seller can offer.

Elhajjar, Samer, LaurentYacoub, and FadilaOuaida (2023), The present and future of the B2B sales profession, Journal of Personal Selling & Sales Management, 44(2), 128141.

Zoltners, AndrisA., PrabhakantSinha, DharmendraSahay, ArunShastri, and SallyE. Lorimer (2021), Practical insights for sales force digitalization success, Journal of Personal Selling & Sales Management, 41(2), 87102.

Steenburgh, Thomas and MichaelAhearne (2018), How to Sell New Products, Harvard Business Review.

-

Moncrief, WilliamC. and GregW. Marshall (2005), The evolution of the seven steps of selling, Industrial Marketing Management, 34(1), 1322. ↩

-

Cox Automotive (2024), Cox Automotives Car Buyer Journey Study Shows Satisfaction With Car Buying Improved in 2023 After Two Years of Declines, Cox AutomotiveInc. ↩

-

PRNewswire (2019), Car Buyers Visiting Fewer Dealerships, Making Faster Decisions as Online Engagement Rises, PRNewswire. ↩

-

S.Skrovan (2017). Why researching online, shopping offline is the new norm, RetailDive, https://www.retaildive.com/news/why-researching-online-shopping-offline-is-the-new-norm/442754/. Accessed 29June2024. ↩

-

G.W. Marshall, W.C. Moncrief, J.M. Rudd, &N.Lee (2012). Revolution in sales: The impact of social media and related technology on the selling environment, Journal of Personal Selling & Sales Management, 32(3),349363 ↩

-

F.Li, J.Larimo, &L.C. Leonidou (2023). Social media in marketing research: Theoretical bases, methodological aspects, and thematic focus, Psychology & Marketing, 40(1),124145. ↩

-

Verbeke, Willem, BartDietz, and ErnstVerwaal (2010), Drivers of sales performance: a contemporary meta-analysis. Have salespeople become knowledge brokers?, Journal of the Academy of Marketing Science, 39(3), 407428. ↩

-

Thaichon, Park, JirapornSurachartkumtonkun, SaraQuach, ScottWeaven, and RobertW. Palmatier (2018), Hybrid sales structures in the age of e-commerce, Journal of Personal Selling & Sales Management, 38(3), 277302. ↩

-

MarcosCuevas, Javier (2018), The transformation of professional selling: Implications for leading the modern sales organization, Industrial Marketing Management, 69,198208. ↩

-

Zoltners, AndrisA., PrabhakantSinha, DharmendraSahay, ArunShastri, and SallyE. Lorimer (2021), Practical insights for sales force digitalization success, Journal of Personal Selling & Sales Management, 41(2), 87102. ↩

-

Zoltners, AndrisA., PrabhakantSinha, DharmendraSahay, ArunShastri, and SallyE. Lorimer (2021), Practical insights for sales force digitalization success, Journal of Personal Selling & Sales Management, 41(2), 87102. ↩

-

Bharadwaj, Neeraj and GarrettM. Shipley (2020), Salesperson communication effectiveness in a digital sales interaction, Industrial Marketing Management, 90,106112. ↩

-

Guenzi, Paolo and JohannesHabel (2020), Mastering the Digital Transformation of Sales,California Management Review, 62(4), 5785. ↩

-

MarcosCuevas, Javier (2018), The transformation of professional selling: Implications for leading the modern sales organization, Industrial Marketing Management, 69, 198208. ↩

-

Rodrigues, WagnerTorres, LucasScienciaDoPrado, and ElianePereiraZamithBrito (2020), O Novo Papel Do Vendedor, GV-EXECUTIVO, 19(4), 1417. ↩

-

Zoltners, AndrisA., PrabhakantSinha, DharmendraSahay, ArunShastri, and SallyE. Lorimer (2021), Practical insights for sales force digitalization success, Journal of Personal Selling & Sales Management, 41(2), 87102. ↩

-

Alavi, Sascha and JohannesHabel (2021), The human side of digital transformation in sales: review & future paths, Journal of Personal Selling & Sales Management, 41(2), 8386. ↩

-

Singh, Jagdip, KarenFlaherty, RavipreetS. Sohi, DawnDeeter-Schmelz, JohannesHabel, KennethLeMeunier-FitzHugh, AvinashMalshe, RyanMullins, and VincentOnyemah (2019), Sales profession and professionals in the age of digitization and artificial intelligence technologies: concepts, priorities, and questions, Journal of Personal Selling & Sales Management, 39(1), 222. ↩

-

Corsaro, Daniela (2022), Explaining the Sales Transformation through an institutional lens, Journal of Business Research, 142, 11061124. ↩

-

T.Teixeira (2019). Desvendando a Cadeia de Valor do Cliente, Alta Books. ↩

-

Teixeira, Thales and Renato Mendes (2019), How to Improve Your Companys Net Promoter Score, Harvard Business Review. ↩

-

The Economist (2019), Conscious Decoupling, The Economist. ↩

-

Teixeira, Thales (2021), Designing A Customer Value-Centric Growth Strategy, The European Business Review. ↩

-

Corsaro, Daniela (2022), Explaining the Sales Transformation through an institutional lens, Journal of Business Research, 142, 11061124. ↩

-

Schunck, JosianeGarcelli (2023), Avaliaes online de produtos: o efeito da fonte de informao na confiana do consumidor., SoPaulo: FGV-EAESP. ↩

-

Fischer, Heiko, SvenSeidenstricker, and JensPoeppelbuss (2022), The triggers and consequences of digital sales: a systematic literature review, Journal of Personal Selling & Sales Management, 43(1), 523. ↩

-

The sales literature has started to highlight a less transactional role for the seller, and many companies have adopted the term sales consultant A.Pappas, E.Fumagalli, M.Rouziou, & W.Bolander (2023). More than Machines: The Role of the Future Retail Salesperson in Enhancing the Customer Experience, Journal of Retailing, 99(4), 518531. ↩

-

Ulaga, Wolfgang and AjayK. Kohli (2018), The Role of a Solutions Salesperson: Reducing Uncertainty and Fostering Adaptiveness, Industrial Marketing Management, 69, 161168. ↩

-

Hughes, DouglasE. and JessicaL. Ogilvie (2020), When Sales Becomes Service: The Evolution of the Professional Selling Role and an Organic Model of Frontline Ambidexterity, Journal of Service Research, 23(1), 2232. ↩

-

Bronnenberg, BartJ., Jean-PierreDub, MatthewGentzkow, and JesseM. Shapiro (2015), Do Pharmacists Buy Bayer? Informed Shoppers and the Brand Premium, *The Quarterly Journal of Economics, 130(4), 16691726. ↩

-

With increasingly informed customers, companies need to adjust their strategies to offer the right level of support and guidance ↩

-

Syam, Niladri and ArunSharma (2018), Waiting for a sales renaissance in the fourth industrial revolution: Machine learning and artificial intelligence in sales research and practice, Industrial Marketing Management, 69, 135146. ↩

Comments